Fintech and Its Significance in the Financial Industry

Fintech, short for financial technology. It empowers individuals and businesses by providing seamless digital platforms for banking, investing, payments, lending, and more. Its significance lies in its potential to democratize financial services, promote financial inclusion, and drive economic growth.

Fintech apps are transforming traditional financial services by leveraging cutting-edge technology. These apps offer a wide range of features that streamline various aspects of personal finance. They provide real-time access to account balances, allow easy money transfers, and simplify budgeting and expense tracking. Moreover, fintech apps enable individuals to invest in stocks and cryptocurrencies. Also, other assets with just a few taps on their smartphones. By integrating artificial intelligence and machine learning, these apps also offer personalized financial advice and tailored recommendations. The rise of fintech apps is revolutionizing the way we interact with our finances. In fact, making financial management more accessible, efficient, and user-friendly for people of all ages.

Read A Guide to Best Practices and Strategies for Fintech App Development

Fintech applications span a wide range of innovative solutions that are reshaping the financial industry. One type of fintech app is a mobile payment app. As a matter of fact, it allows users to make convenient and secure transactions using their smartphones. Digital banking apps provide comprehensive banking services, allowing users to manage their accounts, transfer funds, and pay bills. Investment and wealth management apps empower individuals to track investments, receive market data, and access personalized financial advice. Peer-to-peer lending platforms connect borrowers directly with lenders, offering competitive loan options. Digital wallets store payment card information and enable seamless payments at merchants and online retailers. These are just a few examples of the diverse types of fintech apps.

Let's look at the top ten types of fintech applications.

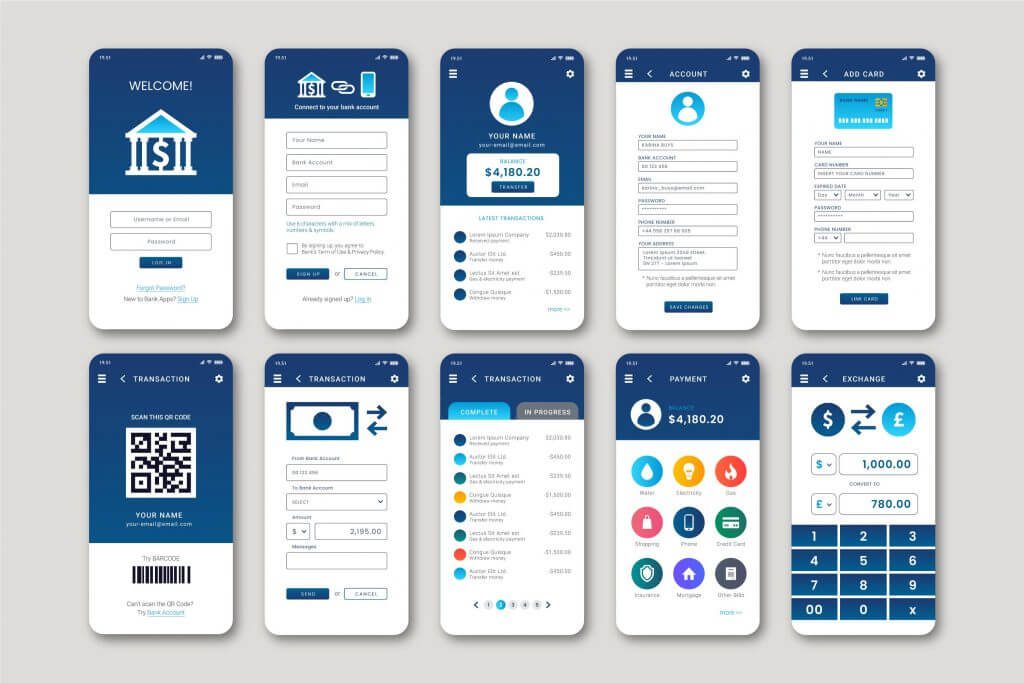

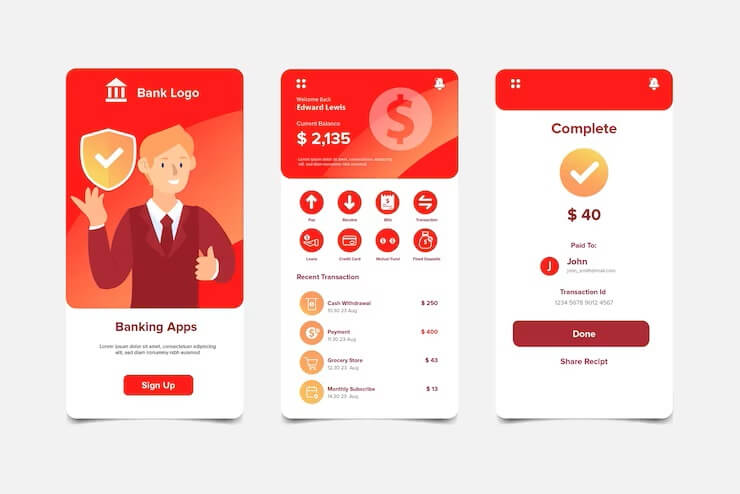

Mobile Banking Apps

Mobile banking apps have revolutionized the way we handle our finances. With just a few taps on our smartphones, we can access our accounts, check balances, transfer funds, and pay bills. These apps provide convenience and accessibility, allowing us to manage our finances anytime and anywhere. They offer enhanced security features like biometric authentication and encryption, ensuring the safety of our sensitive financial information. Mobile banking apps have become an essential tool for individuals. In fact, providing real-time access to our financial transactions and empowering us to take control of our financial well-being.

Benefits of Mobile Banking Apps

Mobile banking apps offer numerous benefits to users, making them an essential tool in today's digital era. Some key advantages include:

- Convenience: Mobile banking apps allow users to perform various financial transactions anytime and anywhere. Also eliminating the need to visit physical bank branches.

- Accessibility: With mobile banking apps, individuals can access their accounts and check balances. Also, make payments, and transfer funds with ease, using just their smartphones.

- Time-saving: By eliminating the need for manual paperwork and in-person visits, mobile banking apps save users valuable time and effort.

- Enhanced security: Leading mobile banking apps employ robust security measures such as biometric authentication, encryption, and also secure connections. As a matter of fact, ensuring the safety of users' financial data.

- Improved financial management: These apps often provide features like spending categorization, budgeting tools, and also transaction history. In fact, empowering users to gain better control over their finances.

Features and Functionalities of Mobile Banking Apps

Mobile banking apps come equipped with various features and functionalities designed to enhance the user experience. Some common ones include:

- Account Management: Users can view account balances and transaction history, and download account statements directly from the app.

- Fund Transfers: Mobile banking apps allow users to transfer money between their own accounts or to other accounts. In fact, within the same bank or different financial institutions.

- Bill Payments: Users can conveniently pay bills, such as utilities, credit cards, loans, and more, directly through the app.

- Mobile Deposits: Many apps enable users to deposit cheques by simply capturing a photo of the cheque using their smartphone's camera.

- Notifications and Alerts: These apps provide real-time notifications and alerts for activities such as account transactions. Also, bill due dates, and account balance updates.

- Card Management: Users can manage their debit or credit cards, including activating or deactivating cards. Also, setting spending limits, and reporting lost or stolen cards.

Cost of Mobile Banking App Development

The cost of developing a mobile banking app can vary depending on various factors. In fact, factors such as the complexity of features, design requirements, platform compatibility (iOS, Android), and development time. It's challenging to provide an exact cost without a detailed understanding of the project's specific requirements. However, mobile banking app development typically involves expenses related to app design, front-end, and back-end development. Also, integration with banking systems, security implementations, testing, and ongoing maintenance and updates. It is advisable to consult with a mobile app development company or fintech app developers to get accurate cost estimates for a specific project.

Payment Gateway Apps

Payment Gateway Apps play a vital role in facilitating secure online transactions between buyers and sellers. Here's an overview of Payment Gateway Apps, including their benefits, features, and the cost of development.

Benefits of Payment Gateway Apps

- Enhanced Security: Payment Gateway Apps employ robust security measures to ensure safe and encrypted transactions, protecting sensitive customer information.

- Convenience: These apps offer a seamless and user-friendly interface. In fact, allowing customers to make payments quickly and easily without the need for physical cash or checks.

- Global Reach: Payment Gateway Apps enable businesses to expand their customer base by accepting payments from customers around the world. It also supports various currencies and payment methods.

- Streamlined Operations: These apps automate payment processes, reducing manual errors, and saving time for both businesses and customers.

- Increased Sales: By providing a smooth and hassle-free payment experience, Payment Gateway Apps contribute to higher conversion rates and also customer satisfaction, ultimately boosting sales.

Features of Payment Gateway Apps

- Secure Payment Processing: These apps utilize encryption protocols to ensure the secure transmission of payment data.

- Multiple Payment Options: Payment Gateway Apps support a wide range of payment methods. It includes credit/debit cards, e-wallets, and bank transfers, accommodating diverse customer preferences.

- Real-Time Transaction Monitoring: Businesses can track and monitor payment transactions in real time. Also, gaining insights into sales performance and revenue streams.

- Integration Capabilities: Payment Gateway Apps seamlessly integrate with various e-commerce platforms, websites, and also mobile applications. It enables businesses to accept payments on multiple channels.

- Customizable Checkout Experience: These apps offer customization options for businesses to brand their payment pages. In fact, providing a consistent and personalized user experience.

Cost of Payment Gateway App Development

The cost of developing a Payment Gateway App depends on many factors. Factors such as complexity, desired features, integration requirements, and also platform compatibility (iOS, Android, web). Custom mobile app development requires significant investment. As it involves backend infrastructure setup, security measures, also payment gateway integration, and testing. Additionally, ongoing maintenance and updates are essential to ensure the app's security and compatibility with evolving technologies. It is advisable to consult with an experienced mobile app development agency. Also, Payment Gateway developers get accurate cost estimates based on specific project requirements.

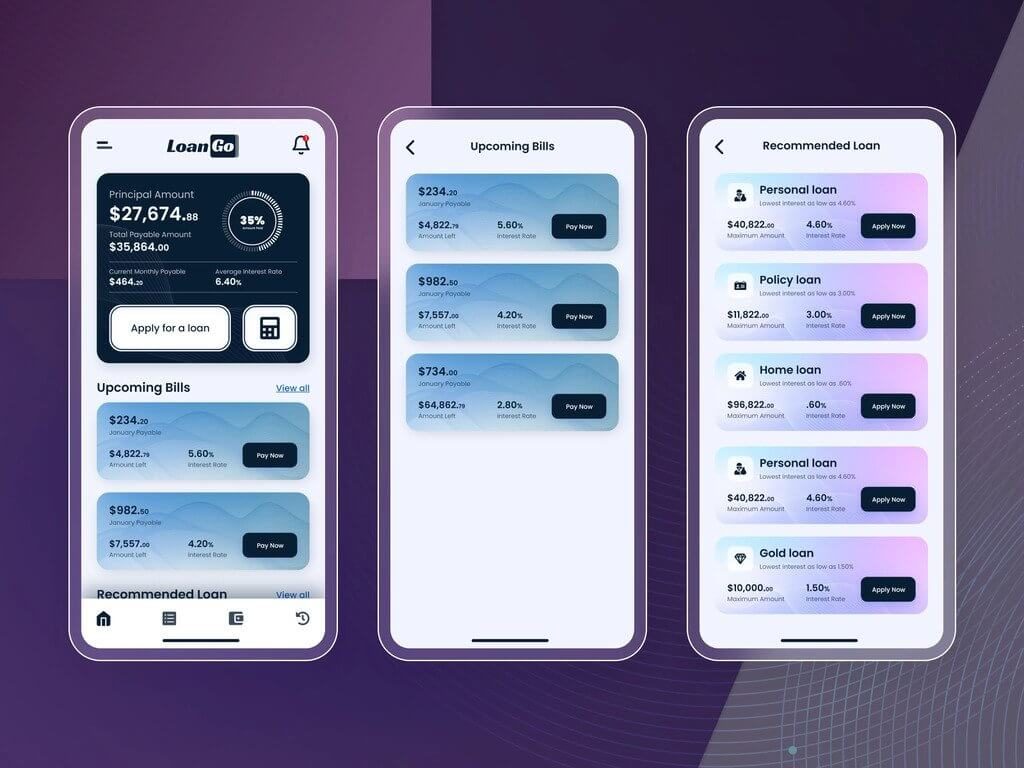

Peer-to-Peer (P2P) Lending Apps

Peer-to-peer (P2P) Lending apps have gained popularity as an alternative financing solution for individuals and businesses. Here's an overview of the benefits, features, and cost of developing a Peer-to-Peer Lending app.

Benefits of Peer-to-Peer Lending Apps

- Access to Financing: P2P Lending apps provide borrowers with easier access to loans. In fact, bypassing traditional financial institutions and connecting them directly with lenders.

- Competitive Interest Rates: P2P lending platforms offer competitive interest rates. It is often lower than those of traditional lenders, benefiting borrowers by reducing the overall cost of borrowing.

- Diversification of Investments: P2P Lending apps allow individuals to invest their money in loans and earn interest. In fact, diversifying their investment portfolio and potentially earning higher returns compared to traditional investment options.

- Streamlined Borrowing Process: These apps simplify the loan application and approval process. Also providing faster funding decisions and quicker access to funds.

- Transparent and Fair: P2P lending platforms promote transparency by providing borrowers and lenders. In fact, with clear information about loan terms, interest rates, and borrower profiles. Thus it enables informed lending decisions.

Features of Peer-to-Peer Lending Apps

- User Profiles: P2P Lending apps enable borrowers to create detailed profiles. Which includes their financial information, credit history, and also loan requirements, helping lenders assess the borrower's credibility.

- Loan Listings and Matching: These apps feature loan listings where borrowers can list their loan requests. And the lenders can browse and choose loans to fund based on their preferences and risk appetite.

- Loan Management: P2P Lending apps provide tools for borrowers and lenders to manage their loans. It includes repayment schedules, interest calculations, and reminders for upcoming payments.

- Communication and Notifications: These apps facilitate communication between borrowers and lenders. In fact, it allows them to discuss loan terms, negotiate, and stay updated on the loan status through notifications.

- Secure Transactions: P2P Lending apps incorporate secure payment gateways and encryption protocols. In fact, this is to ensure the confidentiality and integrity of financial transactions.

Cost of Peer-to-Peer Lending App Development

The cost of developing a Peer-to-Peer Lending app depends on various factors. As a matter of fact, it includes app complexity, desired features, platform compatibility (iOS, Android), and development time. Building a robust P2P Lending app involves expenses related to frontend and backend development. Also payment gateway integration, user authentication and security measures, regulatory compliance, and testing. The cost may also include ongoing maintenance and updates to ensure app performance and security. It is advisable to consult with a professional loan app development company or Peer-to-Peer Lending App developers. In fact, this is to get accurate cost estimates based on specific project requirements.

Personal Finance Apps

Personal Finance Apps have become essential tools for individuals to manage their financial well-being. Here's an overview of the benefits, features, and costs of developing a Personal Finance App.

Benefits of Personal Finance Apps

- Financial Management: These apps help users track their income, expenses, and savings, providing a comprehensive overview of their financial health.

- Budgeting and Goal Setting: Personal Finance Apps enable users to set budgets, and allocate funds to different categories. Also, set financial goals. In fact, helping them stay on track and achieve their objectives.

- Expense Tracking: These apps automate expense tracking by categorizing and analyzing transactions. Giving users insights into their spending habits and areas where they can make improvements.

- Bill Reminders: Personal Finance Apps send notifications and reminders for upcoming bill payments. In fact, this is to ensure that users never miss a payment deadline and avoid late fees.

- Financial Insights and Reports: These apps generate reports and visualizations of users' financial data. In fact, providing valuable insights into their cash flow, savings, and investment performance.

Features of Personal Finance Apps

- Account Aggregation: Personal Finance Apps aggregate financial information from various accounts. This includes bank accounts, credit cards, and also investment portfolios, providing users with a centralized view of their finances.

- Budgeting Tools: These apps offer budgeting features that allow users to set spending limits, track expenses against budgeted amounts, and receive alerts when they exceed their set limits.

- Goal Tracking: Personal Finance Apps enable users to set financial goals, such as saving for a down payment or paying off debt, and track their progress toward achieving those goals.

- Bill Payment Integration: Many apps integrate with bill payment platforms, allowing users to make payments directly from the app and track payment history.

- Data Security: Personal Finance Apps prioritize data security, employing encryption and other security measures to protect users' financial information.

Cost of Personal Finance App Development

The cost of developing a Personal Finance App depends on factors such as app complexity, desired features, platform compatibility (iOS, Android), and development time. Features like account aggregation, budgeting tools, and goal tracking contribute to the development cost. Additionally, integration with financial institutions, data security measures, and ongoing maintenance and updates are also considerations. It is advisable to consult with a professional personal finance app development company or fintech app developers. This in fact to get accurate cost estimates based on specific project requirements.

Investment and Wealth Management Apps

Investment and wealth management app development involves creating mobile applications that enable individuals to manage their investment portfolios, track financial goals, and make informed investment decisions. Here's an overview of the benefits, features, and costs of developing an investment and wealth management app.

Benefits of Investment and Wealth Management Apps

- Convenience: These apps provide users with anytime, anywhere access to their investment accounts, allowing them to monitor and manage their portfolios on the go.

- Portfolio Diversification: Investment apps offer access to a wide range of investment options, including stocks, bonds, mutual funds, and ETFs, enabling users to diversify their portfolios and spread their risk.

- Goal Tracking: These apps allow users to set financial goals, such as retirement planning or saving for a specific milestone, and track their progress towards achieving those goals.

- Data Visualization: Investment apps provide interactive charts and graphs to visualize portfolio performance, asset allocation, and historical returns, making it easier for users to understand their investments.

- Financial Insights: These apps offer personalized insights and recommendations based on user profiles, market trends, and financial data, helping users make informed investment decisions.

- Automation and Rebalancing: Investment apps often incorporate automation features, such as automatic rebalancing and dividend reinvestment, to maintain the desired asset allocation and optimize portfolio performance.

Features of Investment and Wealth Management Apps

- Account Aggregation: Apps integrate with financial institutions to aggregate user investment accounts, providing a consolidated view of all investments in one place.

- Portfolio Tracking: These apps track investment portfolios, providing real-time updates on holdings, performance, and asset allocation.

- Goal Planning and Tracking: Apps allow users to set financial goals, track progress, and receive notifications or recommendations to help achieve those goals.

- Investment Research and Analysis: These apps offer tools and resources for investment research, including market news, company profiles, financial statements, and analyst reports.

- Risk Assessment: Investment apps provide risk assessment tools to help users understand their risk tolerance and align their investment strategies accordingly.

- Security and Privacy: These apps incorporate robust security measures, such as encryption, two-factor authentication, and secure data storage, to protect users' financial information.

Cost of Investment and Wealth Management App Development

The cost of investment and wealth management app development varies based on factors such as app complexity, desired features, platform compatibility (iOS, Android), and development time. Key considerations include integrating with financial data providers, implementing secure payment processing, incorporating data analytics capabilities, and ensuring compliance with regulatory requirements. Additionally, ongoing maintenance, updates, and scalability options are factors to consider. It is advisable to consult with a professional investment and wealth management app development company or fintech app developers. This, in fact, is to get accurate cost estimates based on specific project requirements and the desired level of functionality, security, and scalability.

Robo-Advisors

Robo-Advisors are fintech apps that provide automated investment advice and portfolio management. Here's an overview of the benefits, features, and cost of integrating chatbots and developing a Robo-Advisor fintech app.

Benefits of Robo-Advisors

- Accessibility and Affordability: Robo-advisors make professional investment advice accessible to a wider audience. This in fact is by offering low-cost or even free services, eliminating the need for traditional financial advisors.

- Personalized Investment Strategies: These apps use algorithms to analyze user preferences and risk tolerance. Also, financial goals create customized investment strategies that align with individual needs.

- Diversification and Portfolio Optimization: Robo-Advisors utilize modern portfolio theory and algorithms. This is to create diversified portfolios and optimize asset allocation, aiming to maximize returns while managing risk.

- Cost Efficiency: By leveraging automation and digital processes, Robo-Advisors minimize operational costs. Also, results in lower fees for investors compared to traditional investment services.

- Transparency and Education: Robo-Advisors provide transparent reporting on investment performance, fees, and also portfolio composition. In fact, educating users about their investments and fostering trust.

Features of Robo-Advisor Fintech Apps

- Risk Profiling: These apps assess users' risk tolerance through questionnaires or quizzes to determine suitable investment strategies.

- Automated Asset Allocation: Robo-Advisors automatically allocate funds across different asset classes based on the user's risk profile and investment goals.

- Portfolio Rebalancing: These apps regularly rebalance investment portfolios to maintain the desired asset allocation as market conditions change.

- Goal-Based Investing: Robo-advisors allow users to set financial goals. For example, retirement or saving for a specific milestone, and for the same it provides tailored investment strategies to achieve those goals.

- Performance Tracking and Reporting: These apps provide performance tracking and detailed reports on investment returns, portfolio composition, and also transaction history.

- Integration with Chatbots: Some Robo-Advisors integrate chatbot functionalities to provide personalized customer support, answer investment-related queries, and offer real-time assistance.

Cost of Chatbot Integration and Robo-Advisor Fintech App Development

The cost of integrating chatbots and developing a Robo-Advisor fintech app can vary depending on various factors. In fact, factors such as app complexity, desired features, platform compatibility (iOS, Android), and development time. Chatbot integration requires natural language processing (NLP) capabilities, machine learning algorithms, and backend infrastructure. Additionally, the development cost includes frontend and backend development, API integrations with financial institutions, security implementations, testing, and ongoing maintenance. It is advisable to consult with a professional AI and ML app development company or chatbot developers. This is to get accurate cost estimates based on specific project requirements and the level of chatbot integration desired.

How Fintech Apps Use Algorithms and AI to Provide Automated Investment Advice?

Fintech apps utilize algorithms and artificial intelligence (AI) to provide automated investment advice in several ways:

1. Risk Profiling

Fintech apps use algorithms to assess an investor's risk tolerance. It is by analyzing factors such as financial goals, investment horizon, and also personal preferences. Based on this analysis, the app assigns the investor to a suitable risk profile, ranging from conservative to aggressive.

2. Asset Allocation

Algorithms in fintech apps determine the optimal allocation of assets based on the investor's risk profile. By considering factors such as historical data, market conditions, and also investment objectives. The app automatically allocates funds across different asset classes, such as stocks, bonds, and cash, to create a diversified portfolio.

3. Portfolio Rebalancing

Fintech apps employ algorithms to monitor the performance of a portfolio and automatically rebalance it when necessary. If the asset allocation deviates from the target weights. The app triggers rebalancing by buying or selling assets to bring the portfolio back in line with the desired allocation.

4. Market Analysis and Prediction

Fintech apps leverage algorithms and AI to analyze market data. Also economic indicators, and news to make predictions and inform investment decisions. These algorithms can identify patterns, trends, and correlations, enabling the app to provide insights and recommendations on potential investment opportunities.

5. Personalized Recommendations

Fintech apps utilize algorithms to generate personalized investment recommendations based on an investor's risk profile. Also financial goals, and market conditions. The app considers factors such as the investor's age, income, and investment preferences to offer tailored investment options and strategies.

6. Machine Learning and Natural Language Processing

Fintech apps employ machine learning algorithms and natural language processing (NLP). This is to continuously learn from user interactions and improve their recommendations over time. These algorithms can adapt to changing market conditions and user preferences. Hence enhancing the accuracy and relevance of the automated investment advice provided.

By leveraging algorithms and AI, fintech apps can provide users with automated investment advice. Which in fact is personalized, efficient, and based on data-driven insights. These technologies aim to democratize access to financial expertise and empower individuals to make informed investment decisions.

Click the link to check How AI Chatbots are Empowering FinTech Industry?

Cryptocurrency Apps

Cryptocurrency apps have gained popularity as they enable users to manage their digital assets and participate in the cryptocurrency market. Here's an overview of the benefits, features, and costs of developing a cryptocurrency app or blockchain app development.

Benefits of Cryptocurrency Apps

- Portfolio Management: Cryptocurrency apps allow users to track and manage their cryptocurrency holdings in one place. It is hence providing real-time updates on prices, balances, and performance.

- Secure Storage: These apps offer secure storage solutions for cryptocurrencies. Which includes features such as encrypted wallets and multi-factor authentication, ensuring the safety of users' digital assets.

- Trading and Exchange: Cryptocurrency apps provide access to cryptocurrency exchanges. This in fact allows users to buy, sell, and trade different cryptocurrencies, facilitating investment and diversification.

- Price Monitoring and Alerts: These apps offer price monitoring features, enabling users to set price alerts and receive notifications when cryptocurrency prices reach certain levels, helping users make timely trading decisions.

- News and Market Insights: Cryptocurrency apps provide users with news updates, market analysis, and also insights on cryptocurrency trends. In fact, helping users stay informed and make informed investment decisions.

Features of Cryptocurrency Apps

- Wallet Integration: Cryptocurrency apps integrate with secure digital wallets to allow users to store and manage their cryptocurrency holdings.

- Trading Interface: These apps provide a user-friendly trading interface, allowing users to place buy and sell orders on cryptocurrency exchanges.

- Price Charts and Analysis: Cryptocurrency apps feature interactive price charts, technical analysis tools, and indicators to help users analyze and interpret cryptocurrency market trends.

- Portfolio Tracking and Performance: These apps track users' cryptocurrency portfolios, providing detailed information on holdings, gains/losses, and portfolio performance over time.

- News and Market Data: Cryptocurrency apps display real-time news updates, market data, and social sentiment analysis to keep users informed about the latest developments in the cryptocurrency market.

- Security Measures: Cryptocurrency apps incorporate robust security measures, such as two-factor authentication, biometric authentication, and encryption, to protect users' accounts and digital assets.

Cost of Cryptocurrency App Development

The cost of developing a cryptocurrency app depends on several factors, including app complexity, desired features, platform compatibility (iOS, Android), and development time. Key considerations include integrating with cryptocurrency exchanges and payment gateways, implementing robust security measures, and incorporating real-time data feeds. Additionally, ongoing maintenance, updates, and compliance with regulatory requirements are essential factors to consider. It is advisable to consult with a professional cryptocurrency app development company or fintech app developers. This is to get accurate cost estimates based on specific project requirements and also the desired level of functionality and security.

Cryptocurrency Exchange Solutions

Cryptocurrency exchange solutions refer to the software and infrastructure that enable the trading of cryptocurrencies between users. These solutions facilitate the buying, selling, and exchanging of digital currencies, providing a platform for users to participate in the cryptocurrency market. Cryptocurrency exchange app development involves creating a mobile application that allows users to access and use a cryptocurrency exchange.

Cryptocurrency exchange solutions typically encompass the following key components

- User Interface: The exchange solution includes a user-friendly interface that allows users to create accounts, manage their profiles, and perform various trading activities.

- Order Matching Engine: The order matching engine matches buy and sell orders placed by users on the exchange, ensuring that trades are executed efficiently and accurately.

- Wallet Integration: Cryptocurrency exchanges integrate secure digital wallets to enable users to store their digital assets and make transactions securely.

- Trading Features: Exchange solutions offer various trading features such as market orders, limit orders, stop-loss orders, and margin trading, providing users with different options to execute trades according to their preferences.

- Security Measures: Cryptocurrency exchange solutions implement robust security measures, including encryption, two-factor authentication, and cold storage for offline asset protection, to safeguard users' funds and personal information.

- Compliance and Regulation: Exchange solutions often incorporate features to ensure compliance with local regulations, such as know-your-customer (KYC) and anti-money laundering (AML) procedures, to maintain a secure and legal trading environment.

Cryptocurrency exchange app development involves building a mobile application that provides users with access to the functionalities and features of a cryptocurrency exchange on their smartphones. The development process includes designing a user-friendly interface, integrating necessary APIs and protocols to connect the app with the exchange backend, and implementing security measures to protect user data and funds.

involves building a mobile application that provides users with access to the functionalities and features of a cryptocurrency exchange on their smartphones. The development process includes designing a user-friendly interface, integrating necessary APIs and protocols to connect the app with the exchange backend, and implementing security measures to protect user data and funds.

Cost of Cryptocurrency Exchange App Development

The cost of cryptocurrency exchange app development varies based on factors such as app complexity, desired features, platform compatibility (iOS, Android), and development time. It is recommended to work with an experienced cryptocurrency exchange app development company or fintech app developers who specialize in cryptocurrency exchange solutions to ensure a secure, efficient, and user-friendly app that meets regulatory requirements.

Insurtech

Insurtech or insurance app development involves creating mobile applications or software solutions that leverage technology to improve and streamline insurance processes. Here's an overview of the benefits, features, and costs of developing an insurance app or insurance solution.

Benefits of Insurtech Apps

- Enhanced Customer Experience: Insurtech apps offer a user-friendly interface that simplifies insurance-related tasks, such as policy management, claims processing, and customer support, providing a seamless and convenient experience for policyholders.

- Improved Efficiency: These apps automate and digitize various insurance processes, reducing paperwork, minimizing manual errors, and accelerating the overall insurance workflow for both insurers and policyholders.

- Personalization: Insurtech apps utilize data analytics and artificial intelligence to provide personalized insurance recommendations and tailored coverage options based on user profiles and preferences.

- Real-time Access to Information: Insurtech apps enable users to access policy details, coverage information, and claims status in real-time, ensuring transparency and enabling better decision-making.

- Faster Claims Processing: By incorporating features such as digital claims filing, image recognition, and automated workflows, insurtech apps expedite the claims process, reducing paperwork and improving efficiency.

Features of Insurtech Apps

- Policy Management: Insurtech apps allow users to view, update, and manage their insurance policies, including coverage details, premium payments, and policy documents.

- Claims Processing: These apps provide a digital claim filing process, enabling users to submit claims, upload supporting documents, and track the status of their claims.

- Digital Payments: Insurtech apps integrate payment gateways, enabling users to make premium payments, renew policies, and manage to bill conveniently.

- Policy Recommendations: Based on user data and analytics, insurtech apps offer personalized insurance recommendations, suggesting suitable coverage options and policy enhancements.

- Chatbots and Customer Support: Many insurtech apps incorporate chatbot functionalities or AI-powered virtual assistants to provide instant customer support, answer queries, and guide users through various insurance processes.

- Data Analytics and Fraud Detection: Insurtech apps leverage data analytics and AI algorithms to analyze user behavior, detect fraud, and identify potential risks, enabling insurers to make data-driven decisions and mitigate fraudulent activities.

Cost of Insurance App Development or Insurtech Solutions Development

The cost of insurance app development or insurtech solutions development varies based on factors such as app complexity, desired features, platform compatibility (iOS, Android), and development time. Key considerations include integrating with insurance systems, implementing security measures, incorporating data analytics capabilities, and ensuring compliance with regulatory requirements. Additionally, ongoing maintenance, updates, and scalability options are factors to consider. It is advisable to consult with a professional insurance app development company or fintech app developers to get accurate cost estimates based on specific project requirements and the desired level of functionality and security.

Crowdfunding Platforms

Crowdfunding platform development involves creating an online platform that enables individuals or businesses to raise funds from a large number of people who are interested in supporting their projects or initiatives. Here's an overview of the benefits, features, and costs of developing a crowdfunding platform.

Benefits of Crowdfunding Platforms

- Access to Capital: Crowdfunding platforms provide a means for entrepreneurs, startups, and creative projects to access funding from a diverse pool of individuals, bypassing traditional financial institutions.

- Market Validation: Crowdfunding allows project creators to gauge market interest and validate their ideas before fully launching their products or services.

- Community Engagement: Crowdfunding platforms foster a sense of community by connecting project creators with potential backers who share similar interests or values.

- Exposure and Marketing: Crowdfunding campaigns can generate significant publicity, raising awareness about the project and attracting attention from the media, potential customers, and investors.

- Feedback and Insights: Crowdfunding platforms facilitate direct engagement between project creators and backers, providing valuable feedback, suggestions, and insights that can help refine and improve the project.

Features of Crowdfunding Platforms

- Project Creation and Management: The platform enables users to create and manage their crowdfunding projects, including uploading project details, setting funding goals, and defining rewards or incentives for backers.

- Payment Processing: Crowdfunding platforms integrate secure payment gateways to facilitate transactions, allowing backers to contribute funds to projects using various payment methods.

- Social Sharing and Promotion: Platforms include social sharing features that allow project creators and backers to promote campaigns through social media channels, increasing exposure and reaching a wider audience.

- Backer Communication: Crowdfunding platforms provide messaging or comment functionalities, allowing project creators to communicate directly with their backers, answer questions, and provide updates.

- Project Discovery and Search: Platforms offer search and discovery features, enabling users to explore and find projects of interest based on categories, keywords, or popularity.

- Analytics and Reporting: Crowdfunding platforms provide project creators with analytics and reporting tools to track campaign performance, monitor funding progress, and gain insights into backer demographics and engagement.

Cost of Crowdfunding Platform Development

The cost of crowdfunding platform development depends on factors such as platform complexity, desired features, user interface design, platform scalability, and development time. Key considerations include implementing secure payment processing, integrating social sharing functionalities, developing robust backend infrastructure, and ensuring regulatory compliance. Additionally, ongoing maintenance, updates, and customer support are factors to consider. It is advisable to consult with a professional fintech software development company or fintech app developers to get accurate cost estimates based on specific project requirements and the desired level of functionality and scalability.

Click to read What Are The Startling Trends In Fintech App Development In The Future?

Popular Fintech Solutions Across The World

In the realm of fintech applications, several globally recognized platforms have reshaped the financial landscape. Originating from various parts of the world, these apps have garnered immense popularity and transformed the way we manage our finances.

Hailing from the United Kingdom, "Revolut" has emerged as a leading mobile banking app, offering a comprehensive range of digital banking services, money transfers, and budgeting tools. On the other hand, the United States has given birth to "Stripe," a widely used payment gateway app that enables seamless and secure online payment processing for businesses.

When it comes to peer-to-peer lending, "LendingClub" from the United States has become a prominent platform, connecting borrowers with investors for personal loans. Meanwhile, the personal finance app "Mint," also originating from the United States, has gained popularity for its ability to consolidate financial accounts, track expenses, and create budgets.

In the realm of investment and wealth management, the United States-based "Wealthfront" offers automated investment services and personalized portfolio management, empowering users to achieve their financial goals. Another U.S.-originating app, "Betterment," has carved its niche as a robo-advisor app, leveraging algorithms and AI to deliver automated investment advice.

Cryptocurrency enthusiasts are familiar with "Coinbase," a U.S.-based app allowing users to buy, sell, and store various cryptocurrencies securely. For comprehensive cryptocurrency trading, the Chinese-originating "Binance" serves as a leading cryptocurrency exchange solution, providing an array of trading options for digital assets.

In the insurance sector, the U.S.-developed "Lemonade" stands out as an innovative app that leverages AI technology to offer homeowners and renters insurance policies, simplifying the claims process.

Lastly, originating from the United States, "Kickstarter" has become a renowned crowdfunding platform that connects creators with backers interested in supporting creative projects and innovative ideas.

Conclusion

Overall, we explored a wide range of fintech applications and their significance in reshaping the financial industry. From mobile banking apps to payment gateways, peer-to-peer lending platforms, personal finance apps, investment and wealth management solutions, robo-advisors, cryptocurrency apps, insurance apps, and crowdfunding platforms, these applications have revolutionized how we interact with and manage our finances.

The growth and popularity of these fintech apps have created opportunities for individuals and businesses worldwide. To develop cutting-edge fintech apps, partnering with a reputable fintech app development company is essential. Such a company specializes in creating innovative and secure fintech solutions tailored to specific business needs.