Overview of Fintech App Development

As per the data, the global fintech technology market size is predicted to reach a value of approximately US$ 326 billion by 2026. As we all know, fintech is an amazing amalgamation of financial services and technology. Fintech app development has become an important part of every business as it offers a huge number of benefits. In addition, the fintech industry allows financial companies to implement new and innovative solutions. Fintech applications can be considered as one of the best solutions for the financial service industry. As per a survey, 60% of credit unions and 49% of banks revealed that fintech partnerships are important. This shows that fintech has become an important part of the financial industry.

It is important to understand that fintech app development includes various technologies like artificial intelligence, blockchain, machine learning, and many more. The main aim of a fintech app development company is to develop an application that offers an enhanced user experience.

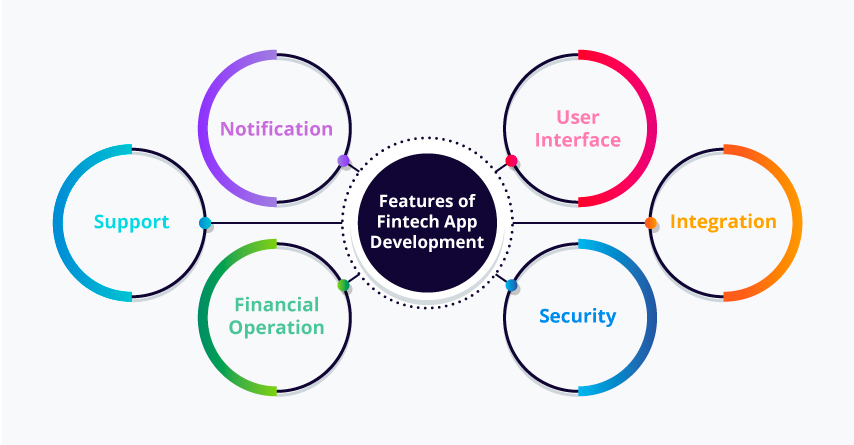

Features of Fintech app development

Fintech app development services include different factors that require the necessary time and expertise. In addition, it is important to offer the right features to the clients so that they can get exceptional results. Also, the features must match the industry standards.

Let’s have a look at some of the most important features of a fintech application:

1. User Interface

The most important thing for an application is that it should have an easy interface. A complex user interface may affect the overall experience of users. Hence, fintech app development companies must make sure that the most important features are easily accessible. If you make the interface easy to understand, then you will be able to enhance the customer experience most effectively.

We can say that a friendly and smooth user interface while fintech mobile app development services will boost customer retention and engage more customers in the long run.

2. Security

The fintech app must be able to provide strong security as it contains financial information for a huge number of users. Furthermore, data security has become one of the most important things for financial companies. To ensure strong security you can use two-factor authentication, blockchain technology, encryption techniques, and many more. Since these applications deal with the most sensitive data, it is crucial to put major emphasis on security.

3. Basic functionalities for financial operations

Before developing any application, first, understand what type of features are needed by your client. In addition, you must understand the business requirements and add the necessary features to give high-quality results. By understanding the requirements, you can add features like account management, money transfer, balance check, and many more. You must make sure that the application contains all the basic features to offer great results.

4. Notifications

Custom notifications are one of the most important features in fintech apps. In addition, the custom notifications act as a bridge between the fintech app and users. These notifications allow users to check salary notifications, industry news, bill payments, and alerts. Hence, we can say that these real-time notifications are important for offering a personalized experience.

The right fintech app development company will make sure to add all the necessary features to make the apps more efficient. However, you have to make sure to connect with a credible fintech app development company to reap all the benefits.

5. Integration

The fintech application must integrate with other applications to fulfill user demand. API is a cost-friendly way to link fintech applications to other applications. In addition, the integration will allow users to link their bank accounts, check balances, make transactions, and many more. The fintech app developers can integrate the fintech applications with payment modes like PayPal and Google Pay so that users can do shopping as well. In short, the integrations will enhance the app’s efficiency to a larger extent.

6. Support

Financial companies deal with highly confidential data on a day-to-day basis. So, it is important to offer 24×7 support to resolve issues within no time. You cannot depend on any third-party services to offer support to your customer. Any slight delay or inconvenience can affect the customer’s experience. Hence, we suggest you have a highly trained customer support team that can offer the right support and guidance most effectively.

Check the Latest Trends In Fintech App Development

Developing A Secure and Scalable Fintech Application

Answering the question How to develop a secure and scalable fintech application? or What is the Fintech app development process?

Let’s have a look at some data.

As per the data, Fintech companies face many problems due to cyberattacks. In addition, we can say that fintech app development companies must keep in mind that they must offer highly secure solutions to clients. Financial companies constantly face problems due to data leakage, ransomware, and many more.

Here are some points that will help you design a secure and scalable fintech application:

1. Make a checklist for security enhancement

The fintech companies deal with strict compliance such as FCA, FTC, GDPR, CRPB, and others. The security practices must be effective enough to protect customer data. In addition, you must share the security protocols with the customer to gain their trust. You have to make a checklist that will decide what should be included in the application. In addition, you must design a security policy for the people involved in application development. If the environment is secure, then you will be able to create a highly secure and effective application.

The identification process is done by creating a username and password. After this, the authentication process confirms the user’s profile. The authentication process is completed by authenticating user-id and passwords. In addition, two-factor authentication is a great option for enhancing the security of an application. The application should also have a payment-blocking feature to save users from fraud and theft. After the authentication and identification process, the next phase is to decide what areas the users are allowed to access.

3. Secure code

During the application programming phase, you have to create correct algorithms to detect any flaws. In addition, this phase is highly crucial as all the customer data is saved on the server. Any bug can affect the overall security authentication of other applications. To make sure that code is agile and easily portable the developers can use the input validation process. The fintech app developers must review the data to avoid any data misuse or fraud.

4. Secure workflows

To avoid any malpractice the developers must make sure to create backups of the important files and customers’ databases. In addition, they should also create a backup system, every three to six months, to avoid any uncertainty. Another important thing is to give data access to a limited number of people. Data access should be given only to the team that is working on application development. Fintech app development companies must prepare non-disclosure agreements for onboarding new employees to save ideas and information being shared with competitors.

5. Testing

In this phase, thorough testing is needed to save the application from bugs or any errors. In addition, testing at each step helps to improve the efficiency of the application. Also, it is important to test the servers, routers, and firewalls to detect malware. Overall, it is important to check tools, servers, and infrastructure for developing a high-quality fintech application.

6. Data encryption

Encryption helps to protect user data and prevent it from being stolen or sent to other parties. In addition, encryption allows the users to access the data via an encryption key. However, encryption does not give protection from data breaches, but it makes sure to restrict third parties from using your information.

Now you may have understood that fintech applications require a high level of security to save data and other useful information. To gain clients’ trust you have to make sure to use the highest security measures. A credible fintech application development company makes sure to design high-quality applications. The company also ensures to give security is a major priority.

Now, as we have seen the process above let’s look at some of the compliance we should comply with.

Ensuring Compliance with Regulatory Frameworks in Fintech App Development

Fintech has become more connected to traditional financial services. A huge number of insurance companies and banks have been partnering with fintech app development companies to enhance their services. If you want to create a fintech app for your company, you must know about compliance. Since the fintech application deals with highly sensitive data, it is important to develop applications that comply with the laws and regulations of a particular country.

Fintech compliance as per the USA, Canada, and Australia

United States

The USA is one of the biggest fintech markets in the world. Hence, they have a wide range of strict laws and regulations for maintaining the fintech industry.

If you are targeting the US market, then you have to abide by US laws and regulations. As depicted in the above image numerous laws maintain the fintech market in the USA.

Financial Crimes Enforcement Network (FinCEN) is a regulatory body that collects data regarding each transaction. The main role of this body is to prevent financial crimes in the country.

Another regulation is the Office of the Comptroller of the Currency (OCC) which regulates and supervises all financial institutions to follow the laws and regulations in the right manner.

The Federal Deposit Insurance Corporation (FDIC) is another regulatory body that examines financial institutions to protect consumers from any fraud.

Apart from this, the Securities and Exchange Commissions (SEC) have been created by the US government to prevent market manipulation. This regulation also helps to protect investors and helps in the smooth functioning of security markets.

Another agency is the Federal Trade Commission (FTC) which is an independent agency that helps to prevent unfair business practices. In addition, FTC also approves new technologies for trading.

In short, we can say that all these regulatory bodies have been designed to protect the financial markets, and consumer data and strengthen security most effectively.

Australia

In Australia the fintech industry is regulated by the Australian Securities and investment commission (ASIC), the Australian Prudential and regulatory authority (APRA), and the Australian transaction report and analysis center (AUSTRAC). ASIC ensures that the financial system is fair, efficient, and transparent for all. In addition, it regulates financial service organizations, financial markets, Australian companies, and many more. Hence, we can say that ASIC mainly focuses on protecting consumers, regulates the market fairly, and promotes innovation.

Canada

Canada has a competitive and strong financial sector. In addition, Fintech companies operating in Canada are subject to a range of regulatory requirements and compliance obligations, which are enforced by various federal and provincial regulators. The key federal regulator for fintech compliance in Canada is the Office of the Superintendent of Financial Institutions (OSFI), which oversees and regulates banks, insurance companies, and other financial institutions.

The Office of the Superintendent of financial institutions (OSFI) is responsible for ensuring that these institutions comply with all relevant laws, regulations, and guidelines. Some other regulatory bodies are the Financial Consumer Agency of Canada (FCAC), the Canada Deposit Insurance Corporation (CDIC), and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). In addition, the Fintech companies may also be subject to provincial regulations and licensing requirements, depending on the nature of their business and the jurisdictions in which they operate.

Fintech companies operating in every country must comply with a range of regulatory requirements related to data protection, anti-money laundering and counter-terrorist financing, consumer protection, and more. We can say that it is important for fintech companies to stay up to date on all relevant regulatory requirements and to work closely with legal and compliance professionals to ensure full compliance.

Let’s have a look at optimization and scalability now.

Optimizing App Performance and Scalability with Cloud-based Technologies

With the help of cloud technologies and apps, companies can access huge amounts of data. This helps the fintech development companies to understand consumer demand and design high-quality products and services. The use of cloud technology offers various benefits like increased security, flexibility, and innovation. One of the major benefits of cloud technology is that it improves the overall efficiency of the fintech industry.

Let’s understand the benefits offered by cloud technologies to the Fintech industry:

A. Helps to Increase Scalability and Flexibility

Fintech is a continuously growing platform so it needs an effective infrastructure that can support them fully at each stage. It has been identified that cloud technology allows fintech app development companies to scale easily. By using cloud technology, fintech companies can develop a flexible and customer-centric business model which in turn increases profitability in the long run.

B. Hassle-free Data Management

Fintechs deal with huge amounts of data daily, so these companies require effective data management. From identity verification to balance checking, all can be possible only with effective data management. To make all the processes hassle-free companies can use cloud technology. Cloud technologies allow fintech app companies to store and manage vast amounts of data. This eliminates the need to hire any specialist for data management and enhances the overall customer experience.

C. Enhance Customer Experience

In recent years cloud technologies have improved the customer experience. In addition, cloud technology allows users to access their accounts anytime, anywhere. Apart from this, cloud technology also gives better insights to fintech companies. In this way, they understand customer requirements and offer high-quality services within no time.

D. Boost Your Speed To Market

By using cloud technology, companies can reduce their time to market. In addition, Cloud computing providers offer infrastructure as a service (IaaS), which allows fintech companies to quickly set up and manage their computing infrastructure without having to worry about hardware maintenance or upgrades. This can significantly reduce the time and costs required to launch new products and services. We can say that the effective utilization of cloud technologies can improve the ability to market new products and services. Also, companies can gain customer trust and offer the most reliable products and services.

Now, let’s look at some technologies helping fintech applications.

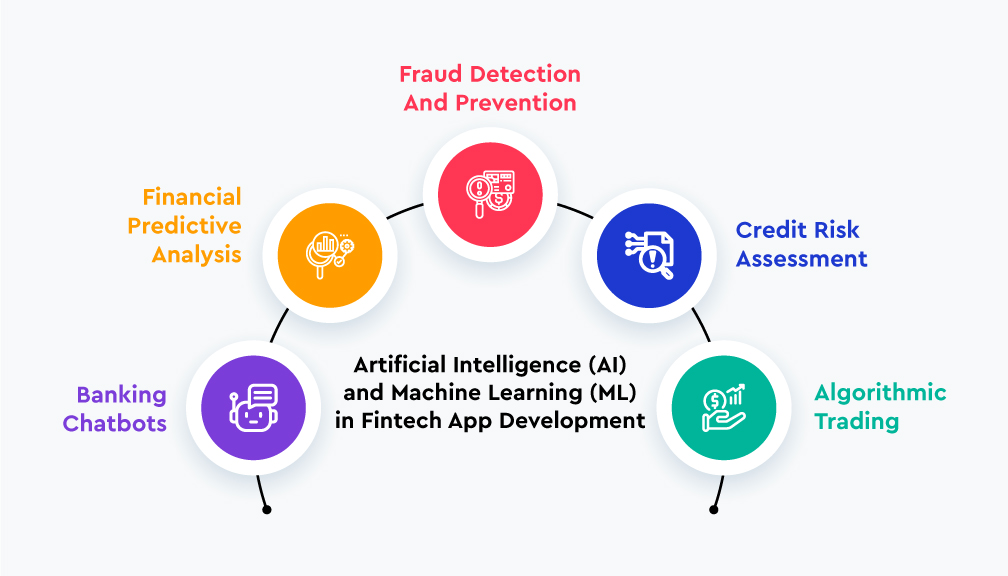

Using Artificial Intelligence (AI) and Machine Learning (ML) in Fintech App Development for Predictive Analytics and Personalization

The use of Artificial Intelligence (AI) and Machine Learning (ML) in the fintech industry is quite impressive. A lot of organizations have been using AI and ML for predictive analytics and personalization. Predictive analytics is one of the major advantages of AI and ML for the financial industry. By using Machine Learning technology in fintech app development the fintech developers improve overall efficiency and enhance the decision-making process.

Machine Learning-powered fintech applications can detect any discrepancy in the user’s transaction and save customers from any kind of fraud. For example, with the help of Machine Learning, the fintech application can automatically block large transactions, withdrawals, access from unusual places, and many more. Hence, this increases security and protects customers from any type of fraud or theft.

Machine Learning technology also helps fintech companies to carry out credit risks assessment. In this way, you can find high-risk customers and save the business from any losses in the future. In addition, banking chatbots have been playing a major role in offering high-quality customer support. With these chatbots, a company can solve customer queries at any time.

The FinTech sector is experiencing rapid and continuous growth, with a focus on customer-centric restructuring. One factor fueling this growth is the integration of AI chatbots in FinTech. By leveraging the power of AI, chatbots are transforming the way customers interact with financial services, enabling personalized experiences, streamlined processes, and improved outcomes.

Check How AI Chatbots are Empowering FinTech Industry?

Some more advantages of AI and ML in Fintech App

It has also been identified that AI and ML algorithms analyze data to predict future outcomes. All these predictions help to maximize the traders’ returns and minimize risks. The reports said that personalization increases the revenue of the fintech industry by 15%. This shows that the financial industry must be able to understand what types of services are preferred by the customers. A report by Mckinsey highlighted that 71% of consumers prefer personalized business interactions. The fintech application development companies use AI and ML to assess customer information like spending trends and preferences.

We can also say that the companies that use AL and ML with fintech can achieve competitive advantage most effectively. It is important to note that AI and ML technology allows you to assess huge amounts of data to make intelligent decisions. To enhance your customer experience and service we suggest you connect with a fintech app development service provider. By partnering with the right fintech app development company you can develop a high-quality application. Apart from this, you must understand how your company can gain better business insight and improve decision-making with a fintech application.

How Managing and Analyzing Data in Fintech Apps Helps for Better Business Insights and Decision-making?

Due to constantly changing customer expectations and lack of personal connection with customers, the fintech industry is focusing on incorporating advanced technologies like machine learning and big data. In addition, the financial sector deals with huge amounts of data on a day-to-day basis so it is important to utilize data effectively.

The right usage of data will allow financial companies to gain better insights and make intelligent decisions within no time. FinTechs may also utilize data analytics to make better use of data. The use of data analytics in the fintech industry has played a significant role in its growth over the past few years. By leveraging advanced analytics techniques such as machine learning, predictive modeling, and data visualization, fintech companies can gain insights into customer behavior, market trends, and risk management.

Check the Role of Digital Transformation in Financial Sector

Here are some ways data analytics has contributed to the growth of the fintech industry:

1. Improved Customer Experience

Fintech companies use data analytics to gain a better understanding of customer needs, preferences, and behavior. This enables them to offer personalized services and products to customers. In addition, data analytics helps to predict future trends and helps you to target the right customers.

2. Enhanced Fraud Detection

Data analytics can help fintech companies detect fraudulent activities in real-time, minimizing the risk of losses due to fraud. The technology analyses improper transactions and other unusual activities to save customers and the company from any fraud.

3. Efficient Risk Management

With the help of data analytics, fintech companies can identify and mitigate risks more efficiently. In this way, you can better risk management and reduce losses.

4. Cost Savings

Fintech companies can save costs by automating various processes and reducing manual work. Data analytics plays a crucial role in enabling automation and reducing the need for manual intervention.

5. Innovation

Fintech companies can leverage data analytics to gain insights into market trends and customer needs. We can say that data analytics has been a key driver of growth in the fintech industry. It also allows companies to better understand their customers, reduce risk, and innovate more efficiently.

If you want to create a highly exceptional fintech application, then we recommend connecting with a credible fintech app development company. The right fintech app development service provider will give you the right guidance and understand all our ideas.

Conclusion

After analyzing all the information, we can say that fintech applications can improve customer satisfaction and services in the most effective manner. Apart from this, a credible fintech app development service company can save you from all hassle and design a high-quality application within no time.

Emorphis Technologies is a top-notch fintech app development company. Our fintech app developers have a huge number of experiences that allow them to design high-quality applications. We offer guidance at each step to understand your requirements. With us, you can attain a competitive advantage and offer satisfactory services to the customers.