Amazing Facts on Fintech App Development

Discover the incredible journey of embracing the future with a leading fintech app development company, and delve into the astounding statistics that showcase their innovative impact on the industry.

Incredible statistics on Fintech app development showcase the remarkable growth and impact of the financial technology industry. According to a report from Statista, as of May 2023, there were a staggering 11,651 fintech startups in the Americas, making it the region with the highest number of fintech startups worldwide. In comparison, the EMEA region (Europe, the Middle East, and Africa) had 9,681 fintech startups, while the Asia Pacific region had 5,061. In 2023, the United States took the lead in the number of fintech unicorns globally, boasting approximately five times more of these companies than the United Kingdom, which secured the second spot.

Another fascinating insight from Statista reveals the dominance of fintech companies headquartered in the United States and China in terms of market capitalization. In 2022, the largest two companies were the payment giants, Visa and Mastercard, both based in the United States, with market capitalizations of approximately 465 billion and 345 billion U.S. dollars, respectively. Following closely was Chinese company Tencent with a market capitalization of 187.92 billion U.S. dollars. Remarkably, European-headquartered companies such as Stripe, Adyen, and Klarna also made it to the top fintech companies by market capitalization.

Furthermore, Statista highlights the substantial value of fintech companies in the United States. In 2021, Stripe emerged as the most valuable fintech company in the country, boasting a remarkable valuation of 35 billion U.S. dollars. Klarna followed closely behind with a valuation of approximately 46 billion U.S. dollars. Impressively, four out of the ten largest fintech deals in 2021 involved companies headquartered in the United States. Also, reinforces the nation’s strong presence in the fintech landscape.

Fintech vs Traditional Banking: Embracing Digital Disruption

The clash between fintech app development companies and traditional banking institutions is dramatically reshaping the financial landscape. On one side, fintech companies armed with cutting-edge technologies and a customer-centric mindset are revolutionizing financial services. The innovative solutions include mobile payment apps and AI-powered robo-advisors. They not only offer convenience but also provide personalized experiences to users.

On the other side, traditional banks, fully aware of the digital shift, are proactively adapting to remain competitive. They are heavily investing in digital transformation initiatives and forming strategic partnerships with fintech startups. In fact, aiming to modernize their services and cater to the ever-evolving customer expectations. As a result, the financial industry is witnessing an exciting transformation where fintech and traditional banking sectors converge to create a more efficient and user-friendly financial ecosystem.

Check the following article providing details on Digital Transformation In Banking and Financial Sector.

As this digital disruption unfolds, the financial industry is witnessing a harmonious convergence of fintech and traditional banking strengths. Customers can expect a wider range of financial services, improved accessibility, and enhanced user experiences. Ultimately, this transformative clash promises to create an inclusive. And also an efficient financial ecosystem that embraces the best of both fintech and traditional banking.

Factors Driving Growth in Fintech App Development and its Adoption

Moreover, the global fintech technologies market has witnessed incredible growth. According to Allied Market Research, the market was valued at an impressive $110.57 billion in 2020 and is expected to achieve an astonishing $698.48 billion by 2030. In fact, exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 20.3% during the period from 2021 to 2030.

This growth is attributed to the application of new technological advancements, such as artificial intelligence (AI), blockchain, data analytics, and application programming interface (API), aimed at improving and automating the delivery and use of financial services. The fintech industry continues to revolutionize the financial landscape by challenging traditional financial methods and offering innovative solutions to meet the evolving needs of consumers and businesses alike.

The Fintech Technologies market has seen remarkable growth, driven by improved financial regulations and increased adoption of advanced technologies. Regulatory authorities worldwide have recognized the importance of fostering fintech innovations, leading to supportive policies and increased investment.

Concurrently, advancements like AI, blockchain, data analytics, and APIs have revolutionized financial services delivery. AI-powered chatbots elevate customer support, while blockchain ensures ironclad transactions. Data analytics offers personalized recommendations, and APIs seamlessly integrate financial platforms. The escalating demand for efficient and user-friendly financial solutions has driven the explosive growth of fintech applications. Also, it provides cost-effective alternatives to traditional services.

This convergence of regulatory support, technological advancements, and consumer demand has created a thriving ecosystem for Fintech Technologies. In fact, propelling continuous growth and driving further innovations in the financial industry.

For more details check the article answering What Are The Startling Trends In Fintech App Development In The Future?

Let’s now explore the diverse range of fintech applications and get insights into their development costs.

Types of Fintech Applications

Types of FinTech applications are constantly evolving to meet the changing needs of consumers and businesses. Several fintech applications are currently trending in the market:

1. Mobile Payment Apps

Amid the widespread use of smartphones, mobile payment apps have witnessed a remarkable surge in popularity. Notably, these apps offer users the convenience of making secure digital transactions. Which includes peer-to-peer transfers, online purchases, and contactless payments at retail outlets. With their user-friendly interfaces and robust security measures, mobile payment apps have seamlessly integrated into modern financial transactions. In fact, transforming the way we handle our day-to-day payments and revolutionizing the overall payment landscape.

2. Peer-to-Peer Lending Platforms

With a disruptive force, peer-to-peer lending platforms have completely revolutionized traditional lending, creating a direct connection between borrowers and lenders. In fact, by offering an appealing alternative to banks, these platforms facilitate easier access to loans and potentially higher returns for investors, reshaping the financial landscape and redefining the dynamics of borrowing and investing.

3. Personal Finance Management Apps

Empowering users with comprehensive financial control, personal finance management apps enable effective tracking and management of finances. Through an array of budgeting tools, expense tracking, investment analysis, and also financial goal planning, these apps actively assist users in making well-informed financial decisions. By providing such diverse and invaluable features, personal finance management apps have also become indispensable tools for achieving financial stability and prosperity.

4. Robo-Advisors

Robo-advisors, leveraging advanced artificial intelligence and powerful algorithms, offer a cutting-edge approach to automated investment advice. In fact, through these platforms, users benefit from professionally curated and managed diversified investment portfolios, all tailored precisely to their risk profiles and unique financial goals. Also, by seamlessly combining technology and finance, robo-advisors have revolutionized the investment landscape, providing users with a simplified yet sophisticated investment experience.

Find more details on How AI Chatbots are Empowering FinTech Industry?

5. Blockchain-based Solutions

Amidst the rapid advancements in financial technology, blockchain technology emerges as a disruptive force, revolutionizing multiple financial processes, such as secure transactions, identity verification, and smart contracts. In fact, by providing unparalleled levels of transparency, security, and decentralization, blockchain-based applications have garnered immense interest from financial institutions seeking innovative solutions to optimize their operations and enhance customer trust. With its transformative potential, blockchain technology continues to reshape the financial landscape, driving us toward a decentralized and more secure financial future.

6. Insurtech Apps

In a transformative wave, insurtech applications are revolutionizing the insurance industry through the provision of streamlined and highly personalized insurance solutions. By harnessing the power of cutting-edge technologies such as AI, data analytics, and IoT, these apps efficiently assess risks, curate tailored policies, and expedite claims processing. The integration of such innovative technologies paves the way for an enhanced insurance experience, empowering customers with efficient and customized coverage while propelling the insurance industry into a new era of digital excellence.

7. Digital Lending Platforms

Digital lending platforms, with their seamless integration of technology, ushering in a new era of simplicity and efficiency in the loan application process, while significantly accelerating approval times. By leveraging cutting-edge technology to assess creditworthiness, these platforms not only reduce cumbersome paperwork but also offer borrowers rapid access to much-needed funds. As the financial landscape embraces digitalization, digital lending platforms emerge as a game-changer, empowering borrowers with faster and hassle-free access to credit, and also heralding a more agile and customer-centric approach to lending.

8. Crowdfunding Platforms

In a revolutionary approach, crowdfunding platforms empower individuals and businesses alike to raise funds for their projects, also initiatives, or ventures through the collective support of a large number of people, who contribute small amounts. In fact, with the advent of such platforms, traditional fundraising methods have taken a backseat, as crowdfunding introduces a more inclusive and community-driven approach to financing. As crowdfunding gains momentum, it continues to democratize fundraising opportunities, offering a viable and accessible avenue for turning dreams into reality, regardless of the scale or nature of the endeavor.

9. Digital Wallet Apps

Digital wallet apps store payment information securely and also allow users to make transactions without physical cards. In fact, they facilitate contactless payments, online shopping, and money transfers.

These trending fintech applications demonstrate the industy’s continuous innovation and also focus on enhancing financial services for consumers and businesses alike. As technology advances and customer demands evolve, the FinTech landscape is expected to witness even more exciting developments in the future.

For more details click the link to read about Types of Fintech App Development

Cost Estimate of Fintech Applications

The cost estimate for developing a Minimum Viable Product (MVP) of a FinTech app can vary significantly based on several factors. As a matter of fact, these factors include the complexity of the app, the number of features, the technology stack used, the region of development, the expertise of the development team, and the time required to complete the development.

However, as a rough estimate, the cost of developing an MVP for a FinTech app can range from $50,000 to $150,000 or more. Also, this estimate is a general range and may differ depending on the specific requirements and scope of the MVP.

It’s important to note that an MVP is a basic version of the app with minimal features, in fact, designed to test the concept and gather user feedback. The cost of the full-fledged app with additional features and functionalities would be higher.

For accurate and personalized cost estimates for MVP development, it’s advisable to consult with experienced FinTech app development companies or professionals. They can analyze your specific project needs and provide a more precise estimation based on your requirements.

Type of FinTech Application and its Cost

Have a look at a comprehensive table showcasing the consolidated view of various types of fintech app development costs across the regions.

| Type of FinTech Application | Description | Estimated Hours for Development | Cost Estimate (USD) |

| Mobile Payment Apps | Apps enabling seamless mobile transactions and digital payments. | 800 – 1,200 hours | $50,000 – $150,000 |

| Peer-to-Peer Lending Platforms | Platforms connecting borrowers and lenders for direct lending. | 1,200 – 1,800 hours | $80,000 – $200,000 |

| Personal Finance Management Apps | Apps providing tools to manage personal finances and budgets. | 600 – 1,000 hours | $40,000 – $120,000 |

| Robo-Advisors | Automated platforms offering algorithm-based investment advice. | 1,500 – 2,500 hours | $100,000 – $250,000 |

| Blockchain-based Solutions | Solutions leveraging blockchain technology for various use cases. | 1,800 – 2,800 hours | $120,000 – $300,000 |

| Insurtech Apps | Applications transforming the insurance industry with technology. | 800 – 1,200 hours | $60,000 – $180,000 |

| Digital Lending Platforms | Platforms facilitating online lending and loan management. | 1,000 – 1,500 hours | $70,000 – $200,000 |

| Crowdfunding Platforms | Platforms enabling fundraising through small contributions. | 800 – 1,200 hours | $50,000 – $150,000 |

| Digital Wallet Apps | Apps offering digital storage and easy access to payment methods. | 600 – 1,000 hours | $40,000 – $120,000 |

Please note that the estimated hours and cost ranges provided above are approximate and can vary depending on the project’s complexity, features, technology stack, and other factors.

For accurate and up-to-date estimates, it’s essential to consult with a software development company in each specific region.

Tech Stack For Fintech App Development

Fintech app development relies on a robust and diverse tech stack to deliver secure, reliable, and feature-rich financial solutions. The tech stack may vary depending on the specific requirements of the app, but here’s an elaboration of the key components commonly used in fintech app development:

A. Front-End Technologies

- Programming Languages: Front-end development typically involves languages like HTML, CSS, and also JavaScript, which enable the creation of user interfaces and interactions.

- Frameworks and Libraries: Popular front-end frameworks like React, Angular, or Vue.js, along with libraries like Bootstrap, help in building responsive and also visually appealing UI/UX designs.

B. Back-End Technologies

- Programming Languages: Back-end development often involves languages like Python, Java, PHP, Ruby, or Node.js, which also handle server-side logic and data processing.

- Frameworks and Tools: Fintech apps benefit from the use of frameworks such as Django (Python), Spring (Java), or Express.js (Node.js), which expedite development and enhance security.

C. Database Management

- Relational Databases: Fintech apps commonly use relational databases like MySQL, PostgreSQL, or Microsoft SQL Server, also ensuring data integrity and structured storage.

- NoSQL Databases: Non-relational databases like MongoDB or Cassandra are utilized for handling large volumes of unstructured data, also supporting scalability and flexibility.

D. Security and Authentication

- Encryption: Fintech apps employ encryption algorithms like SSL/TLS to secure data transmission between the app and servers, in fact, ensuring data privacy.

- OAuth: OAuth protocols enable secure and standardized authentication, as a matter of fact, allowing users to authorize third-party access to their financial data without exposing login credentials.

E. Cloud Services

- Cloud Infrastructure: Cloud platforms like AWS, Azure, or Google Cloud provide scalable and reliable hosting, ensuring high availability and also reduced infrastructure management costs.

- The Cloud Storage: Cloud-based storage solutions facilitate data storage, backups, and also seamless access to data across devices.

F. API Integration

- Open Banking APIs: APIs compliant with Open Banking standards allow seamless integration with financial institutions’ systems, enabling users to access and also manage their accounts securely.

- Third-party APIs: Integration with various payment gateways, currency exchange APIs, and also other third-party financial services extends the functionality of fintech apps.

G. Machine Learning and AI

- ML Libraries and Frameworks: Libraries like TensorFlow, Scikit-learn, or PyTorch enable the implementation of machine learning algorithms for tasks like fraud detection, credit scoring, and also customer behavior analysis.

H. Blockchain Technology

- Smart Contracts: For decentralized applications and secure transaction execution, also smart contract platforms like Ethereum are employed.

- Consensus Mechanisms: Blockchain networks implement consensus algorithms like Proof of Work (PoW) or Proof of Stake (PoS) to validate transactions and maintain the integrity of the network.

I. Testing and Monitoring

- Automated Testing: Tools like Selenium, Jest, or JUnit automate testing processes to ensure app functionality and also reliability.

- Error Monitoring: Fintech apps utilize tools like New Relic or Sentry to monitor app performance, identify issues, and also resolve bugs promptly.

The use of these technologies in combination ensures that fintech apps deliver a seamless and secure user experience while complying with regulatory standards. As the fintech industry continues to evolve, developers may adopt new technologies to further enhance the functionality and capabilities of these apps.

Compliance with Fintech App Development

Compliance with fintech app development is a critical aspect that varies significantly across regions due to varying regulatory frameworks and legal requirements. In fact, Fintech app development companies must meticulously navigate these regulations to ensure the security of users’ financial data, protect against fraud, and maintain trust in the financial system.

America

In the United States, for instance, fintech app development companies must comply with federal regulations such as the Bank Secrecy Act (BSA), Anti-Money Laundering (AML) rules, and the Consumer Financial Protection Bureau (CFPB) guidelines. Additionally, at the state level, each fintech app development company faces unique licensing requirements and consumer protection laws.

European Union

In the European Union (EU), compliance is of utmost importance for fintech app development companies operating in member countries. Also, they must adhere to the General Data Protection Regulation (GDPR) to safeguard user data and privacy. Furthermore, the EU’s Revised Payment Services Directive (PSD2) mandates strong customer authentication for financial transactions and encourages open banking through seamless API integration.

Likewise, in the United Kingdom, fintech app development companies are obliged to comply with the Financial Conduct Authority (FCA) regulations, which encompass AML and Know Your Customer (KYC) requirements. Embracing the UK Open Banking initiative further facilitates secure data sharing and streamlined API integration between financial institutions and fintech apps.

Asia

In Asia, the scenario is no different. Regions like Singapore and Hong Kong present unique challenges for fintech app development companies. In fact, they must diligently adhere to regulations enforced by the Monetary Authority of Singapore (MAS) and the Hong Kong Monetary Authority (HKMA), respectively. Such regulations include AML, robust cybersecurity measures, and also consumer protection protocols. Moreover, Singapore offers a regulatory sandbox as a controlled environment for fintech app development companies to test innovative solutions.

Australia and Canada

The same holds true for fintech app development companies in Australia and Canada. These companies are mandated to comply with rigorous regulations set forth by the Australian Prudential Regulation Authority (APRA), Australian Securities and Investments Commission (ASIC), Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), and the Office of the Superintendent of Financial Institutions (OSFI).

As a matter of fact, to succeed in the highly competitive fintech industry, fintech app development companies must prioritize strict compliance with these diverse regulatory requirements. Maintaining legal adherence ensures the trust and confidence of users, financial institutions, and also regulatory authorities alike. As the fintech landscape continues to evolve, fintech app development companies must remain agile, adaptive, and also committed to upholding compliance standards to stay at the forefront of innovation and client service.

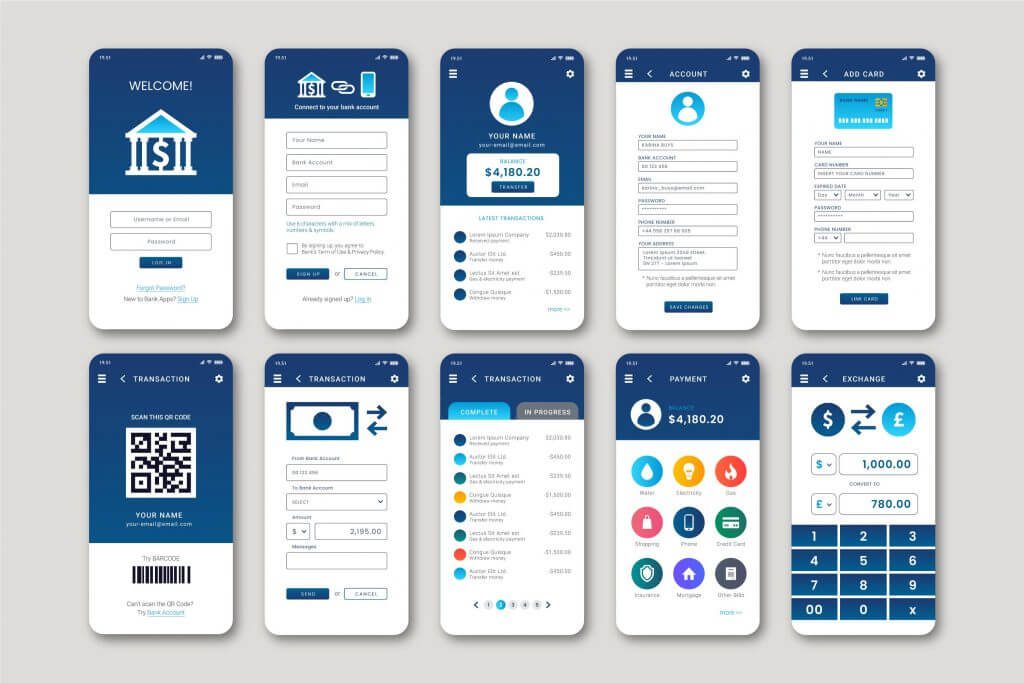

Fintech Software and App Development Process

Developing a FinTech application involves several essential steps that require the expertise of a reputable fintech app development company. Below are the detailed steps to create a successful FinTech app:

1. Market Research and Idea Validation

Before starting the development process, conduct thorough market research to identify the target audience and understand their needs and pain points. In fact, validate your app idea by analyzing the competition and identifying gaps in the market that your app can fill. This research will also help you tailor your app to meet the specific requirements of your target users.

2. Defining the Scope and Features

Clearly define the scope of your Fintech app by listing the features and functionalities you want to include. In fact, this step is crucial as it sets the foundation for the entire development process. Work closely with your fintech app development company to prioritize features based on user needs and also market demands.

3. User Experience (UX) Design

A seamless and user-friendly interface is essential for a successful FinTech app. In fact, collaborate with designers to create an intuitive and visually appealing user experience. Also, use transition words to guide users through the app’s flow and ensure a smooth navigation process.

4. Technology Stack Selection

Choose the appropriate technology stack based on your app’s requirements. As a matter of fact, your fintech app development company will help you select the right programming languages, frameworks, and tools to ensure the app’s scalability, security, and performance.

5. Integration of Cutting-Edge Technologies

Leveraging advanced technologies like blockchain, artificial intelligence (AI), and data analytics can enhance the app’s functionality and also security. For example, blockchain technology can be used for secure transactions, while AI and data analytics can provide personalized financial recommendations and fraud detection.

6. Development and Testing

The fintech app development company will proceed with the actual development of the app, in fact, ensuring that it aligns with the defined scope and features. Rigorous testing is essential at each stage of development to identify and resolve bugs, also ensure smooth functionality, and comply with industry standards.

7. Security and Compliance

Security is paramount in fintech app development. In fact, implementing strong encryption, secure authentication methods, and should comply with relevant financial regulations like AML and GDPR. Also, use transition words to clearly communicate the app’s security measures to users.

8. Launch and Deployment

Coordinate with your fintech app development company to plan a successful app launch. Test the app thoroughly on different devices and platforms to ensure compatibility. Once ready, deploy the app to the app stores for users to download and use.

9. Post-Launch Support and Updates

The development process doesn’t end with the app’s launch. Provide continuous fintech app development services, including regular updates, bug fixes, and customer support. Regularly gather user feedback to make improvements and enhancements to the app.

By following these steps and partnering with a skilled fintech app development company, you can create a successful FinTech application that meets user needs, delivers a seamless experience, and drives your business towards success in the dynamic fintech industry.

How Emorphis Technologies Can Help in Fintech App Development?

Emorphis Technologies is a leading fintech app development company with a proven track record of delivering innovative and secure fintech app development services. With a team of skilled developers and cutting-edge technologies, Emorphis Technologies is well-equipped to assist businesses in creating successful fintech applications that cater to the evolving needs of users.

a. Expert Consultation and Planning

Emorphis Technologies starts by offering expert consultation to understand your specific requirements and app idea. Their experienced team analyzes market trends, user expectations, and competitor insights to provide valuable recommendations. They work with you to define the scope, features, and technology stack required for your fintech app.

b. Customized UX/UI Design

User experience (UX) and user interface (UI) design are crucial for fintech apps. Emorphis Technologies excels in crafting customized, intuitive, and visually appealing interfaces that ensure seamless user experiences. Transition words and design elements guide users through the app’s flow, simplifying navigation.

You can also check more details with A Guide to Best Practices and Strategies for Fintech App Development

c. Cutting-Edge Technology Implementation

Emorphis Technologies leverages cutting-edge technologies like blockchain, AI, data analytics, and cloud computing to enhance the functionality and security of your fintech app. They integrate these technologies seamlessly to provide advanced features such as secure transactions, personalized financial recommendations, and fraud detection.

d. Agile Development and Rigorous Testing

The company follows an agile development approach, dividing the project into sprints for continuous development and testing. Thorough testing is performed at every stage to promptly detect and address any issues that may arise. Emorphis Technologies ensures that your fintech app meets the highest quality standards and is ready for deployment.

e. Security and Compliance Focus

Security stands as a paramount concern for fintech apps, and Emorphis Technologies goes to great lengths to ensure stringent security measures are in place. During the app development process, they incorporate strong encryption and secure authentication methods. Moreover, they adhere strictly to pertinent financial regulations, such as AML and GDPR.

By employing effective transition words, Emorphis Technologies educates users about the app’s robust security measures, fostering a sense of trust and confidence. Users can rest assured that their sensitive financial information is safeguarded at every step, making the fintech app a reliable and secure platform for their needs.

f. Seamless App Launch and Deployment

With Emorphis Technologies’ expert assistance, a successful app launch is guaranteed through meticulous planning of deployment and app store submission. Moreover, they conduct rigorous testing across various devices and platforms to ensure perfect compatibility. With their unparalleled expertise, your fintech app will be fully prepared for users to download and enjoy a seamless experience from the very start.

g. Post-Launch Support and Updates

Beyond the app launch, Emorphis Technologies goes the extra mile by providing comprehensive fintech app development services. These services encompass regular updates, bug fixes, and continuous customer support. Furthermore, they actively collect user feedback to implement essential improvements and enhancements to the app. This commitment to ongoing improvement ensures that their fintech app remains at the cutting edge of performance and user satisfaction.

Conclusion

Emorphis Technologies is a leading fintech app development company that offers comprehensive services to cater to diverse business needs. Firstly, with expert consultation, they skillfully define the app’s scope, features, and technology stack. Moreover, they focus on customized UX/UI design, ensuring a delightful user experience with seamless navigation and a visually appealing interface.

Furthermore, Emorphis Technologies excels in integrating cutting-edge technologies such as blockchain, AI, data analytics, and cloud computing. This enhances the app’s functionality and security, fostering user trust through secure and encrypted protocols. Additionally, they prioritize compliance with essential financial regulations like AML and GDPR to safeguard user data.

Check our Fintech Case Studies

The company follows an agile development approach, facilitating systematic and timely progress with rigorous testing at each stage. This ensures that the fintech app meets the highest quality standards before deployment. Additionally, they support a seamless app launch, handling app store submission, and conducting tests for compatibility across various devices and platforms.

After the launch, Emorphis Technologies remains committed to providing outstanding fintech app development services. Additionally, through regular updates, bug fixes, and continuous customer support, they ensure seamless app operation and prompt issue resolution. Notably, the company actively gathers user feedback to make necessary refinements, leveraging valuable insights. As a result, their dedication to excellence shines through in every aspect of their service.

In today’s fast-evolving fintech landscape, Emorphis Technologies stands out as an ideal partner for businesses seeking innovative fintech app solutions. Their holistic approach, expertise, and unwavering dedication position them at the forefront of fintech app development. Consequently, they empower businesses to thrive in the dynamic and highly competitive fintech industry.

With Emorphis Technologies as your fintech app development company, you can confidently create a successful and sustainable fintech application that not only meets business objectives but also exceeds user expectations.