Introduction

Gone are the days of standing in a long queue just to deposit cheques outside banks. It has happened because of the arrival of mobile technology. Yeah, you heard it right. Let us now look at the details of the mobile banking app.

With the dawn of mobile apps, all the banking and financial institutions have undergone phenomenal transformation towards advancing and upgrading technologies to meet customer’s expectations.

During its initial phase of expansion, mobile applications were not only taking the world by storm but also came towards the periphery of the banking sector and conquered it with a boom!

Before venturing more on the topic, first, try to answer some questions related to mobile apps. Let’s venture deep into this exciting journey!

What are Mobile Banking Apps?

First, banking as a sector is evolving with each passage of time and has revolutionized the way people look towards it by providing its services to run successfully on a mobile phone (or smartphone). Does that make any sense?

Yes, because it has disrupted the way of conducting financial services and has enhanced the reliability of the banks among the people. But what is mobile banking?

It is a service offered by banking and other financial institutions to permit customers to perform financial transactions remotely using their mobile devices. Unlike Internet banking, it uses software called an app which is provided by the respective financial institution to fulfill online banking purposes.

Hey, wait! You might be puzzled that online banking and mobile banking are different. How are they unique from each other? Let’s find out!

Differences Between Online Banking and Mobile Banking Apps

Even though online banking services have proved their caliber and have made financial transactions highly convenient for people, it is mobile banking that is in demand among digital users. Do you know why?

It is because digital users are smarter than you think and are ready to try new products that suit their persona. Besides the constantly evolving digital world, they are willing to adopt those trends that make banking simpler.

The same has happened with the onset of mobile banking which has made the banking procedure extremely convenient just at the fingertip of digital users and thus has become part and parcel of their life.

Some key differences between online and mobile banking are illustrated below:

I. Definition

Internet banking is a service that permits the conduction of financial transactions by customers using the Internet. Mobile banking is an internet-based facility provided by the bank to customers for executing bank transactions via mobile devices.

II. Functionality of Online & Mobile Banking

The functionality is the key difference between online and mobile banking services. Online banking is done through a PC (or laptop) with an internet connection mandatory. Alternatively, mobile banking can be done with or without the internet and even through SMS.

III. Accessing the Online Banking Portal & Mobile Banking App

Online banking portal is accessed from any browser without downloading the software, whereas mobile banking can be accessed only by downloading the appropriate banking app.

IV. Transaction Facilities

More banking facilities are provided through the online portal of the bank which simplifies internet banking. On the other hand, limited facilities are offered from mobile banking to the customers.

V. Opening of Online Banking & Mobile Banking Account

Your banking credentials are needed for opening an online banking account, but in the case of mobile banking, you must apply for it separately. Besides, various banks allow applying mobile banking through online portals.

VI. Funds Transfer

Fund banking in online banking is conducted using NEFT, RTGS, and IMPS and mobile banking is done through NEFT or RTGS.

These are some of the key differences that separate mobile banking from that of internet banking. Now, the importance of mobile banking for a bank will be discussed in the next step.

Why Mobile Application is Gaining Importance in the Banking Sector?

Before answering the given question, first, go through some important facts collected by Statista:

- 30% decrease in the use of physical banks since 2017

- 33% increase in the use of mobile banking since 2016

- Estimate increase in users of smartphones up to 3 billion by 2020

The facts clearly indicate that the time has arrived for financial institutions to develop their personalized mobile banking apps to enhance their competitiveness. What’s more, the present generation consumer will always prefer Internet banking instead of visiting the bank.

Therefore, the time has arrived that banks should take note of it and develop user-friendly banking options via an app which, in turn, will help them win back their audience’s loyalty.

In addition to this,

There are ample benefits your FinTech institution will avail by incorporating mobile banking apps into their fold. Some of the advantages of building mobile apps are:

- Lowering of expenses incurred upon banks

- Significant improvement in customer experience

- High Return on Investment (ROR)

- Gathering customer analytics to improve client-oriented services

- Provision of push and in-app notifications to retail customers

- Utilization of AI to personalized customer services

Thereby, mobile applications have become necessary for banks to successfully sustain this cut-throat competition. In the next section, core features will define mobile banking app development.

Core Features that Define Performance of Mobile Apps

While creating mobile apps for a banking institution, two important features must be given utmost importance which are:

- Security: A prime factor to make your app safe from a data breach

- Simplicity: A feature that makes the app prominent among digital users

Besides, various other features make mobile apps successful among online customers. Some of them are as follows:

- Properly Working Login/Restoration Page

- Clear Showcase of Transaction History/Online Passbook

- Provision of Push Notification

- Presence of Feedback System

- Well-laid Integration with Social Media Channels

- Availability of Customized Structure

- Google Indoor Map

- Payment Gateway Integration

- Presence of One-Click Contacting

- QR/Barcode Scanner Integration

- Usability of Bank Apps in Offline Mode

- And, so on

Exclusive Functions of a Mobile Banking App

Custom mobile banking apps must offer various basic functionalities for their proper working by users such as:

- Making easy bill payments (internet, mobile communications, fines, etc.)

- Making a money transfer successful (digital payment, other banks, account of the same person)

- Proper checking of transactions’ history & account balance

Moreover, there are various additional assets of the mobile app which act as an advantage for any banking institution.

These are:

- Receiving text messages for every transaction

- Push notification to get an alert about money debited/credited to the account

- Generate a summary of account activity reports

- Availability of Geo-location features to discover the nearest bank office

- Provision of currency conversion facility

Types of Mobile Banking Apps with their Special Features

A custom mobile banking app solution emphasizes more on meeting the specific requirements of the customers. So, depending on their demands; numerous mobile banking apps with exclusive features are present to showcase the functional scope of your mobile banking app.

a) Basic Mobile Banking Apps

These are suitable for low prospective markets and come with various features such as:

- Account Management

- Money Transfer

- Payment Scheduling

- GPS Navigation

- Customizable Alerts

b) Advanced Mobile Banking Apps

They come with personalized and differentiated mobile banking experience through features such as:

- Customized bank product offering

- Personal financial management

- Integrated loyalty program

c) A-Class Mobile Banking Apps

It offers a digital platform with a seamless transaction experience by combining features of basic and advanced mobile banking apps with some extra-added features:

- Self-Service Features

- Pre-Login Functionality

- Cardless ATM Withdrawals (with QR Technology)

- Voice Navigation

- Live Chat

- And Many More

Besides, there are two more types of mobile banking apps- employee-oriented (only for bank employees), and user-oriented (customers using banking services).

Best Mobile Banking Apps for Android and iOS

Millennials are the ones who are famous for purchasing most of the products and do not like to wait in the queue. This fact also applies to banks and to meet their requirements, banking apps came into existence.

Now they have everything at their fingertips right from online cash transfers to locating the nearest ATM! Sound’s good isn’t it?

But a question arises- How to pick the best banking apps? It has been made possible by checking customer reviews (positive and negative) about mobile apps and finding their rating on the Apple App Store and Google Play Store.

Popular Apps

Furthermore, information was also collected from various reliable surveys to get a good analysis of various apps. Some of these excellent apps are listed below:

- Bank of America: Hi-Tech Security-based Mobile Banking App

- Ally Bank: Best Online Mobile Banking App

- Capital One: Best Customer Service Provider Mobile Banking App

- Wells Fargo: Renowned Mobile Banking App for Monitoring Investments

- Chase: Finest Mobile Banking App for Prepaid Cards

- PNC Bank: Mobile Banking App Famous for Cardless Purchases

- Discover: Rewards providing Mobile Banking App

These are some of the best mobile banking apps that have appealing features and is up to you to select the one best suited for your business.

Notable Challenges in Building Innovative Mobile Banking Apps

If you are thinking that building a mobile banking app is easy; then you are digging your own grave! It is because there is a dark side also which will have a severe impact on the customers once the app becomes functional.

Challenges

Let’s explore several challenges which are trying to put a speed-brake on building innovative Fintech apps:

- Lack of Security is a Grave Concern for Protecting Customers’ Data

- Lack of Catering Cross-Platform Digital Experience to Banking Customers

- Compiling with Strict Regulations is a Difficult Task

- Difficult to Stay Updated with the Latest Trends

- Reducing the Development Time is No Mean Task

These are some of the challenges which will pose a serious threat to the building-up of a user-friendly mobile banking app for the welfare of the customers. Therefore, to cope with the above-given challenges; various factors should be taken into consideration, and then proceed with selecting the best-suited technology to build mobile banking applications.

Factors to Consider Before Choosing Technologies for Mobile Banking Apps

It is an uphill task to develop mobile apps for banking and other FinTech sectors because various technologies are taken into consideration. It is because the given sector requires that the banking app must be both competitive and functional so that customers get highly secure, authenticated, and UI/UX-based apps to ease their financial transactions.

However, there are a few fundamental principles that you should keep in mind when developing a mobile banking app without confusing yourself to make your project an utter failure.

I. Project Type for your app

A vital determinant in choosing the perfect technology for mobile banking app development. For example, if you are creating an app with platform-specific and great performance; then using technology such as Swift language will be beneficial for you.

II. Security from a Customer Perspective

Security is a multi-dimensional issue that you can ignore at your own peril. Once developed, apps must be properly secured from any breach that might affect their efficiency. So, thinking from the customer’s perspective; choose those technologies that can minimize the human element in security control.

III. Apps must be Future-Proof

Just making your app more secure is not enough to meet your customers’ expectations. You must use technologies that come with updated features and focus on recent marketing trends to make your banking app more user-friendly and acceptable among people.

IV. The Banking App should be mobile-responsive

The present generation is drifting towards mobile banking because they want to manage their budget precisely with minimum screen taps and this is possible only with an authentic mobile experience. So, choose that technology that offers a mobile-responsive app to your clients.

V. Choosing Technology to Introduce App for Customers Quickly

Today is a time with stiff competition and if you choose a technology that has an ample number of ready-made solutions, then it will be crucial for you to have a great competitive advantage against your rivals.

VI. Apps must be Differentiable to Stay Away from Competitors

If you are one step ahead of your competitors; then no one can stop your app from having wide appeal among your audience. To get a competitive edge, select a technology that should include an outstanding feature in your mobile banking services and stand out among the crowds successfully.

VII. Personalized App is a Stepping-Stone to Success in the Banking Sector

Surely, having an extra feature in the banking app will give you a competitive edge, but offering a high user experience will make your app more successful. Choose that technology that collects relevant customers’ information and helps in meeting their expectations wisely.

Best Technology Stacks for Mobile Banking App Development in 2020

To ensure a highly rewarding and successful mobile app, it becomes crucial for you to select the correct technology app to not only give it a new lease of life but also make it more committed to your functional requirements. Selecting a perfect technology will lower costs and take less time for efficient FinTech app development.

We have reviewed various popular approaches and advanced technologies that will be best suited for your mobile apps and fulfill the criteria explained in the above-given step.

Native App Development

It implies using platform-specific technologies for some devices and its operating system (iOS and Android).

Technology Stack for iOS-based Mobile Banking App

You should consider the following technology stack to create your banking application for iOS:

i. Objective-C

Provides the developers object-oriented capabilities & dynamic runtime environment to build robust solutions. Most widely used for app development in the Apple system.

ii. Swift

Provides the developers with less error-prone codes & dynamic libraries to enhance app performance with advanced features that can be easily maintained.

iii. Apple XCode

A full-featured development environment to support user interface and debugging tools.

iv. iOS SDK

It is a software development kit that serves as a link between software apps and the platform on which they run.

Technology Stack for Android-based Mobile Banking App

You should consider the following technology stack to create your banking application for Android:

i. Java

It is an object-oriented programming language that helps developers by providing vast open-source tools with libraries and creating a highly secure banking app as compared to apps created using another programming language.

ii. Kotlin

It provides a lightweight and clean solution to solve API deficiencies and is capable of improving the existing flaws in Java-based app models.

iii. Android Studio & Developer Tools

It offers a flexible build/deploy system using on-device debugging tools, emulators, and various other features to develop high-quality and unique mobile apps.

iv. Android SDK

A software development kit capable of serving as a link between software apps and the platform on which they operate and helps in updating the app with the latest features.

Cross-Platform App Development

In this approach, the focus is more on developing mobile apps that run on multiple platforms as it becomes easy for developers to use a single code base.

Technology Stack for Cross-Platform Apps

Let’s consider some frameworks which help in building cross-platform apps.

i. React Native

An open-source JavaScript-based framework which is the most preferred mobile app development technology for building native apps for Android and iOS platforms.

ii. C#

The major language for cross-platform development allows using device-specific APIs and functionality from its code.

Hybrid App Development

It is a blending of native and web solutions where the core of the apps is written using web technologies which are then embedded in native apps.

Technology Stack for Hybrid Apps

Let’s consider some frameworks that help in building hybrid apps and see how they work.

i. HTML5

It is one of the best technologies to build front-end-based web applications for mobile devices.

ii. Ionic

It uses HTML programming language to build native-based apps for creating UI functionalities for them with great ease.

iii. PhoneGap

It is a popular mobile app development framework for developing hybrid apps to provide a cost-effective solution to users.

Other Technologies

Some other Technologies that are as useful for effective mobile banking app development as the above-given tech stacks are:

1. Node.JS

A Cutting-edge front-end technology that helps in building network apps provides many tools and libraries to create a robust framework.

2. Swift

It is an open-source programming language that adds modern features such as minimum coding with easy maintenance to make programming more flexible and fun.

3. C++

It acts as a foundation base for most of the programming language and is a versatile tool for creating dynamic apps on multiple platforms.

4. PHP

A great language is renowned for designing dynamic mobile apps and creating wonders for apps with database integration.

5. Appcelerator

It is an open-source mobile engagement platform that can create native apps for Android, iOS, and Windows.

So, these are some of the most renowned and popular technologies that can be utilized by developers for creating a highly functional FinTech app for the banking and other financial industries.

Top Mobile Banking App Development Trends to Watch out in 2020

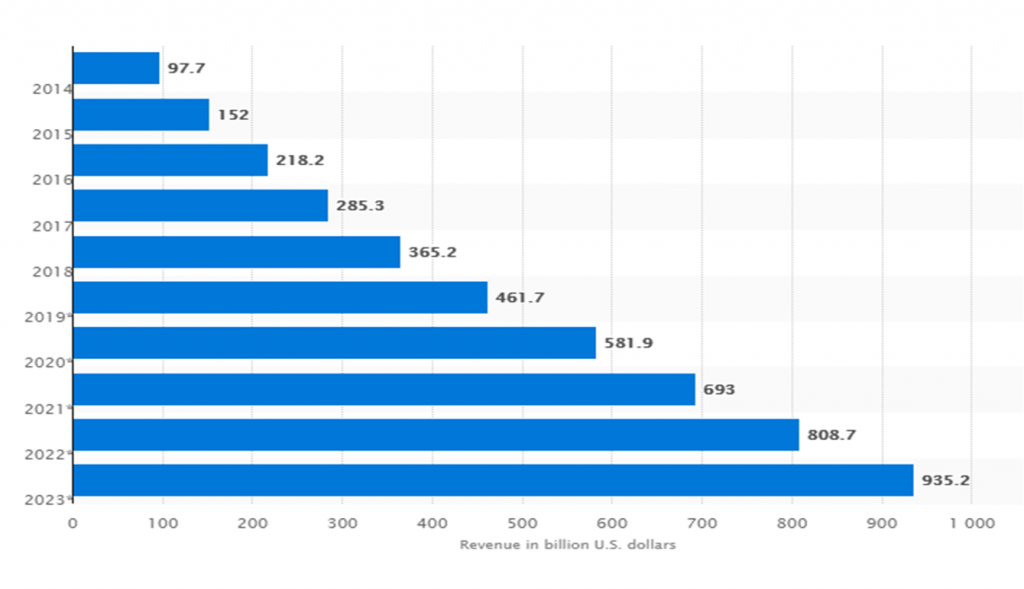

With the rise of smartphone technology, things have gone beyond imagination. Henceforth, mobile app development has become a leading game-changer in business as it has now become a major source of revenue for the companies as shown in the below figure:

It has been estimated by the experts that there will be about a 10.5% increase in mobile app revenue in 2023 (935 billion US$) from 2014 (98 billion US$). The given fact displays that the future of banking rests on mobile apps.

Thus,

Recent trends bet for greater expansion of mobile app development across the globe. Since the visibility of a brand has gotten a great boost via mobile technology, almost every financial sector is trying to reap benefits from it.

So, the future of mobile banking is brighter which is indicated by the latest trends that will dominate the year 2020.

1. Voice Payment will be the New Norm in Banking Services

By taking security concerns into account, many banks have included voice payment in FinTech apps as a means of the two-way authentication system for customers so that they can securely access their accounts.

2. Thanks to Big Data, Fraud Detection is Easier than ever Before

With increased cases of fraudulence; safeguarding the resources of FinTech businesses and protecting the customers’ identity becomes the top priority of banking institutions. So, they have adopted big data engine risk assessment procedures to reduce and minimize the impact of fraud.

3. Customer Service will get Boost-Up via Machine Learning & Smart Bots

Smart bots provide personalized real-time services by predicting consumer behavior and helping them to make payments and save money in an easy format. It is done by using machine learning to meet the customers’ expectations most proficiently.

4. Rise & Rise of Cardless ATM Withdrawals

It is a crucial trend that will revolutionize the banking industry shortly. Various mobile banking solutions offer cardless transactions using payment exchanges like PayPal to card-free ATM transactions.

5. Paydown Apps will Sustain Debt Payoffs

A trend-setting mobile banking trend, it will offer a quick way for customers to come back on track with their finances and help loan holders pay off their debt swiftly.

Why are Customers Switching to a Mobile Banking App?

The simple, answer lies in the question itself! It is because the customer is not fooled enough to go to the bank and avail of those services that they can receive at home! By providing banking software solutions to the users, operating bank accounts is easier now.

But the mobile banking app does more than that. If you want to know about it more, then look at some solid reasons:

- 24/7 Support & Access to customers thus negating the traditional banking systems that disrupted the services previously

- Easy to use with enhanced security

- All-in-one App to provide a single solution for every problem with just one click

- A single app with high cost-effectiveness and a great time-saver

- Comes with speedy transactions to accomplish work swiftly

- Personalized Services present at your Doorstep

- Customers have full control over customer finances

- Capable of automating regular payments

With so many facilities available to the customers, then who will go to the bank and waste precious time in their life? Indeed, mobile banking is poised to be the future of banking!

Key Insight into Building-Up of Successful Mobile Banking App Development

There are different stages for building a successful mobile banking application for the designated FinTech company:

a. Planning

In this stage, relevant data is gathered to clarify project details. For a successful product, careful planning is imminent and is possible through:

- Target market research

- Analyzing competitor offering

- Defining key issues

- Generation of ideas to solve issues

- Evaluating best procedures

- Choosing an operating system that the app supports

b. UI/UX Design

The look of the app is more important among customers and thus the role of designers becomes more prominent than the developers. So, they need to work first before the developers and make their operating with codes easier.

c. Development

In this stage, the completed design is vitalized using two development processes, namely:

- Frontend development- the User interface is converted into functioning code

- Backend Development- Deals with data integration and security

d. Testing

Different types of testing should be accomplished during the development process to ensure the final product remains in perfect shape.

e. Marketing & Deployment

This stage focuses on persuading customers to purchase the products through various mediums and providing necessary feedback.

f. Maintenance & Support

To make your mobile banking app perform well, further maintenance and updating features must be included in them.

Cost Estimation of Banking App Development

To develop a secure mobile banking app, its cost will depend entirely on:

- Concept of the app and its features

- Hiring mobile app developers who are expertise in converting your idea into software

- Effective app design and platform on which the app will run

- The procedure of integrating your app with another banking system

- Guarantee of maintenance and support after delivering ready-to-use app

Apart from this, developers always contact security experts with expertise in the financial domain to incorporate preventive security measures and invest wisely which also adds to the cost.

To Sum Up

Henceforth, the study has revealed that the FinTech industry is a specific sector where building a successful mobile solution requires some special efforts to win customers’ loyalty.

The takeaway- a good banking app is not just a cool buddy; it is more about the delivery of a rewarding financial experience to its beloved customers! So, if you want to add value to your FinTech app development then focus on:

- Giving high priority to the app security as people need bank accounts with high safety features instead of a seamless user experience

- Personal financing is the need of the hour and by allowing people to track expenditures and plan budgets, you are providing them more than enough

This guide is, therefore, here to help you have smooth sailing towards achieving a good banking app to meet the expectations of your clients in the most appropriate manner.

Further, click the link to find the details of Choosing the right Enterprise Mobility solution for your Business